How to Decide which Payment Gateway is Right for Your Business

By Shikhar Srivastava

4 min read | Updated on December 9, 2024, 14:35 IST

With more businesses moving online every month, finding the best payment gateway is essential. Studies show that 71% of Indian consumers now prefer online shopping. Payment methods like cards, net banking, UPI, and digital wallets make digital payments simple and accessible. So, businesses need a payment gateway that makes transactions fast, easy, and convenient for customers.

What is a Payment Gateway?

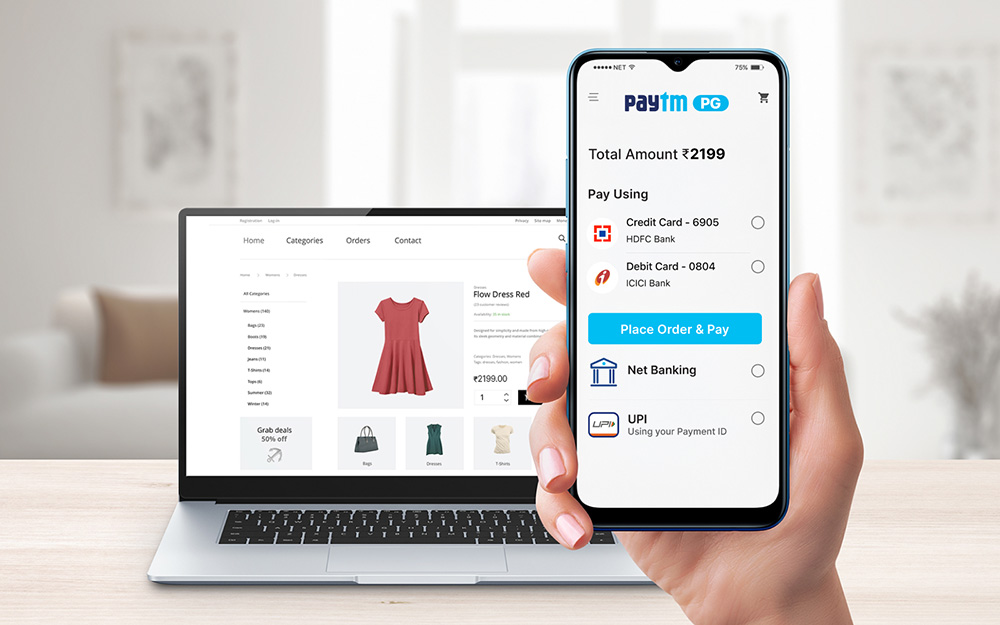

A payment gateway enables businesses to accept payments online through various channels and devices. It acts as a link between the customer's and merchant's bank accounts, authorizing transactions through payment options like net banking, debit and credit cards, wallets, and UPI.

Here are a few questions you should ask before selecting a payment gateway:

- What is the cost of the service it provides?

- What specialities do they present that will keep my business and customers secure?

- How easy or difficult will it be for me to start accepting digital payments?

- Does the payment gateway support international transactions?

We understand the importance of these questions and have listed the best payment gateway features to help you get the answers you need.

7 Essential Features That Make a Payment Gateway the Perfect Choice for Your Business

#1. Merchant Dashboard: For Easy & Powerful Accessibility

One of the major pain points for small business owners is the reconciliation of payments. You must be able to track from where the payments have come and which ones are pending. The Paytm Payment Gateway’s robust business dashboard gives you complete command over your business’s inbound and outbound cash flows, bank accounts, and events, all on a single platform.

Here’s how:

- Transaction Management: Handle your business transactions, initiate refunds, resolve disputes, and receive same-day settlements through a single dashboard. You can also download reports and gain valuable insights in real-time to make informed business decisions.

- Bank Account Management: The dashboard allows you to conduct and maintain your account without hassles. You can edit your business details, bank details, notification settings, and more with ease.

- Notifications: With the dashboard, you will receive notifications for every event, ensuring that you stay informed and can take timely actions on the go.

#2. International Payments: Reach Customers in 200+ Countries

Accepting international payments can often be a hurdle for Indian businesses. The ability to sell abroad depends on various factors, including transaction types, security, trust, settlement time, and the currencies a payment gateway supports. Moreover, having a payment gateway that is trusted by international customers is essential.

The Paytm Payment Gateway empowers you to accept international payments in all major currencies, unlocking significant revenue streams for your business and alleviating common pain points.

#3. Instant Refunds: Enable Zero Waiting Time on Your Transactions

Instant refunds are becoming the new standard and are central to providing an excellent customer experience. Many consumers hesitate to use online payment methods due to the time-consuming nature of obtaining refunds through online platforms. This often leads them to prefer cash-on-delivery (CoD) as a safer alternative.

With the advancements in the fintech ecosystem, customers rightfully expect swift refunds. Paytm Payment Gateway allows businesses to enable zero waiting time with instant refunds, helping to enhance user experience and trust in your brand.

#4. Subscriptions: Seamless Recurring Payment Solutions

Recurring payments allow you to set up automated billing cycles for your customers, making them particularly suitable for organizations that have monthly payment plans. According to Statista, the market size of the digital subscription economy worldwide is expected to reach $1.5 trillion by 2025*.

With the Paytm Payment Gateway’s subscriptions functionality, you can easily collect recurring payments while also providing your consumers with free trials. Furthermore, you can secure an upfront fee and automate recurring payments in a single step, whether you charge customers a fixed amount or based on their usage.

#5. Unlock Growth and Stay Ahead of the Competition with Paytm Payments Affordability Suite

In today's competitive market, businesses are constantly seeking ways to enhance customer affordability and increase sales, especially during high-demand periods like festive seasons. Customers often face barriers when considering large purchases, leading to abandoned carts and lost sales opportunities.

The Paytm Payments Affordability Solution is a merchant-centric initiative designed to help businesses provide flexible payment options such as easy EMI plans, No-Cost EMI alternatives, and enticing bank offers for large-ticket purchases. This solution aims to increase the affordability of products and services, optimize merchants' revenue streams, foster customer loyalty, and strengthen their competitive edge in the market. By converting window shoppers into loyal customers through accessible payment options, businesses can drive growth and enhance customer satisfaction.

#6. Developer-Friendly SDKs: Integrate a Payment Gateway Swiftly & Securely

Having an easy and efficient way to integrate the process of collecting online payments on your online shop is crucial when selecting a payment gateway. This becomes especially important as different developers have varied preferences.

Paytm Payment Gateway’s SDKs offer solutions that cater to diverse requirements. They are compatible with apps built on both native and hybrid frameworks. Paytm Payment Gateway Integration options include SDK or non-SDK integration for apps developed on native frameworks, while apps developed on hybrid frameworks can utilize the relevant bridges provided under the All-In-One SDK solution.

#7. Value-Added Services to Make it Even Better

As businesses navigate the complexities of online payments, they often require additional support and resources to streamline their operations and enhance their customer service.

Paytm Payments Services addresses these needs through its Value-Added Services. Beyond standard aggregation services, we offer dedicated helpdesk support tailored to assist businesses with their queries and blockers. This commitment to customer service ensures that merchants have the guidance they need to effectively manage their payment processes and address any challenges that may arise, ultimately leading to a more efficient and effective online payment experience.

On a Concluding Note

Choosing the right payment gateway is critical for businesses to prosper in the digital marketplace. Paytm Payment Gateway provides a complete set of features that make it a popular choice for Indian companies. From rigorous security measures and simple integration to a variety of payment alternatives and excellent customer service, Paytm Payment Gateway checks all the boxes. By utilizing these capabilities, businesses can improve their payment processes, increase client trust, and drive growth effectively.