Auto-debit offers a one-click payment experience for your website or mobile app enabling payments via Paytm Wallet, Paytm Postpaid and your gift vouchers issued by Paytm. Your customers need to once authorize and link their Paytm account with your application and later enjoy superfast checkout every time.

Note: Paytm Auto-Debit is only available to select enterprise customers with high transaction volumes and established businesses. Get in touch to request access to Paytm Auto-Debit payment solution.

STEP 1: Link a user’s Paytm account with your application

Demo of Paytm Account Linking

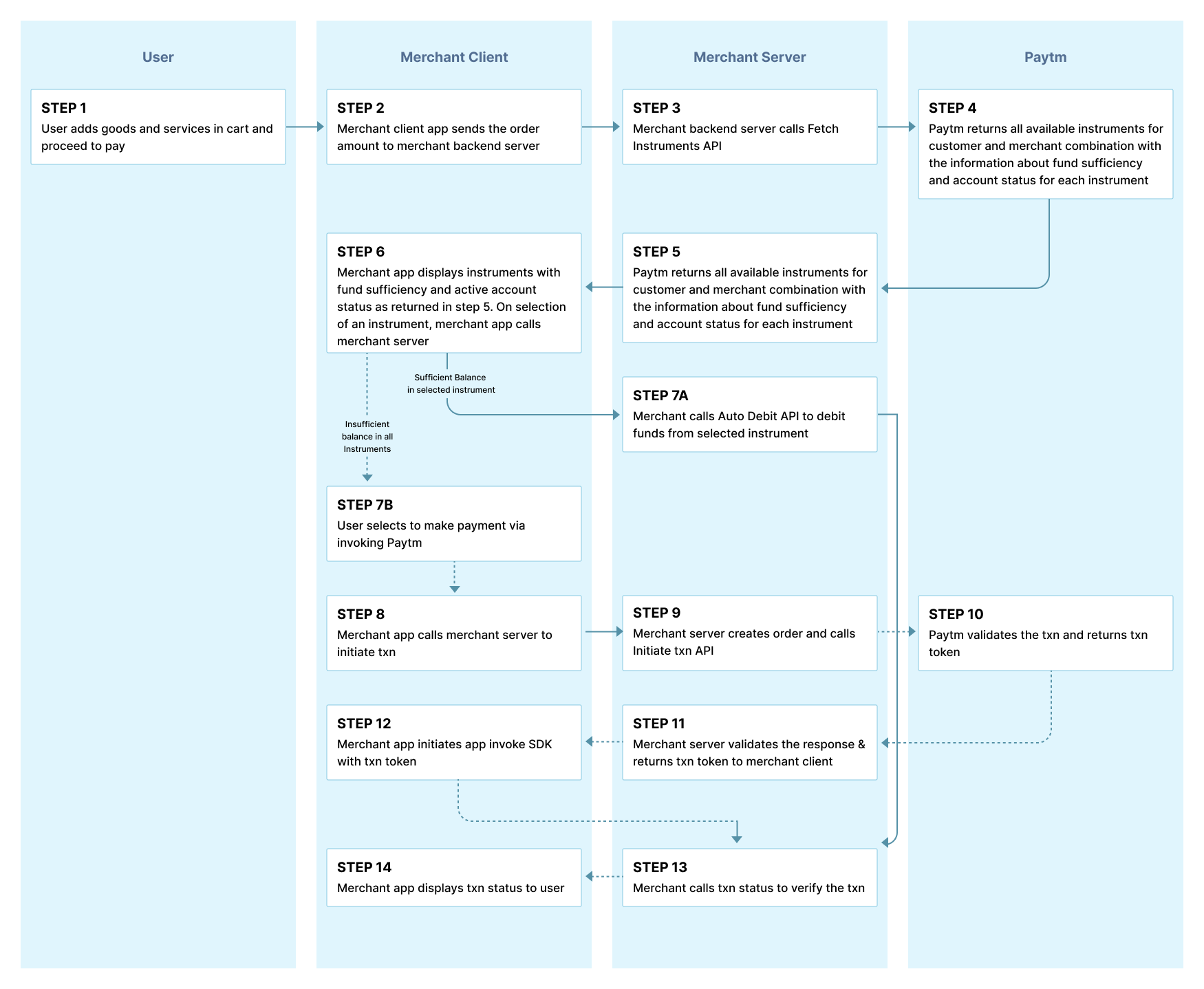

Find the detailed interaction of each system component for Paytm account linking in the flowchart below:

You can see below the list of APIs and their use cases with respect to the Paytm account linking on merchant app/website.

| Usecase category |

API Name |

Description |

| Send OTP to entered mobile number |

Send OTP API |

This API is used to send an OTP to a user's mobile number so as to start linking of Paytm user’s account on merchant web/app. |

| Linking of Paytm account |

Validate OTP API |

This API is used to verify the OTP entered by the user and provide the required tokens in response.

- The tokens received (Access and Refresh token) are specific to client Ids provided by Paytm

- Access token which is also known as SSO token is an identifier for Paytm user account

- Refresh token has longer validity and is used to retrieve a new SSO token on its expiry

|

| Refresh Paytm user’s SSO token |

Refresh Token API |

This API is used to retrieve the new SSO token of the Paytm user account upon its expiry |

| Validate Paytm user’s SSO token |

Validate Token API |

This API is used to validate the Paytm user’s SSO token |

| De-link Paytm user’s account |

Revoke Access API |

This API is used to expire the Paytm user’s SSO token. This is done in the case a user deletes or de-links the account on your application. |

STEP 2: Fetch available payment instruments

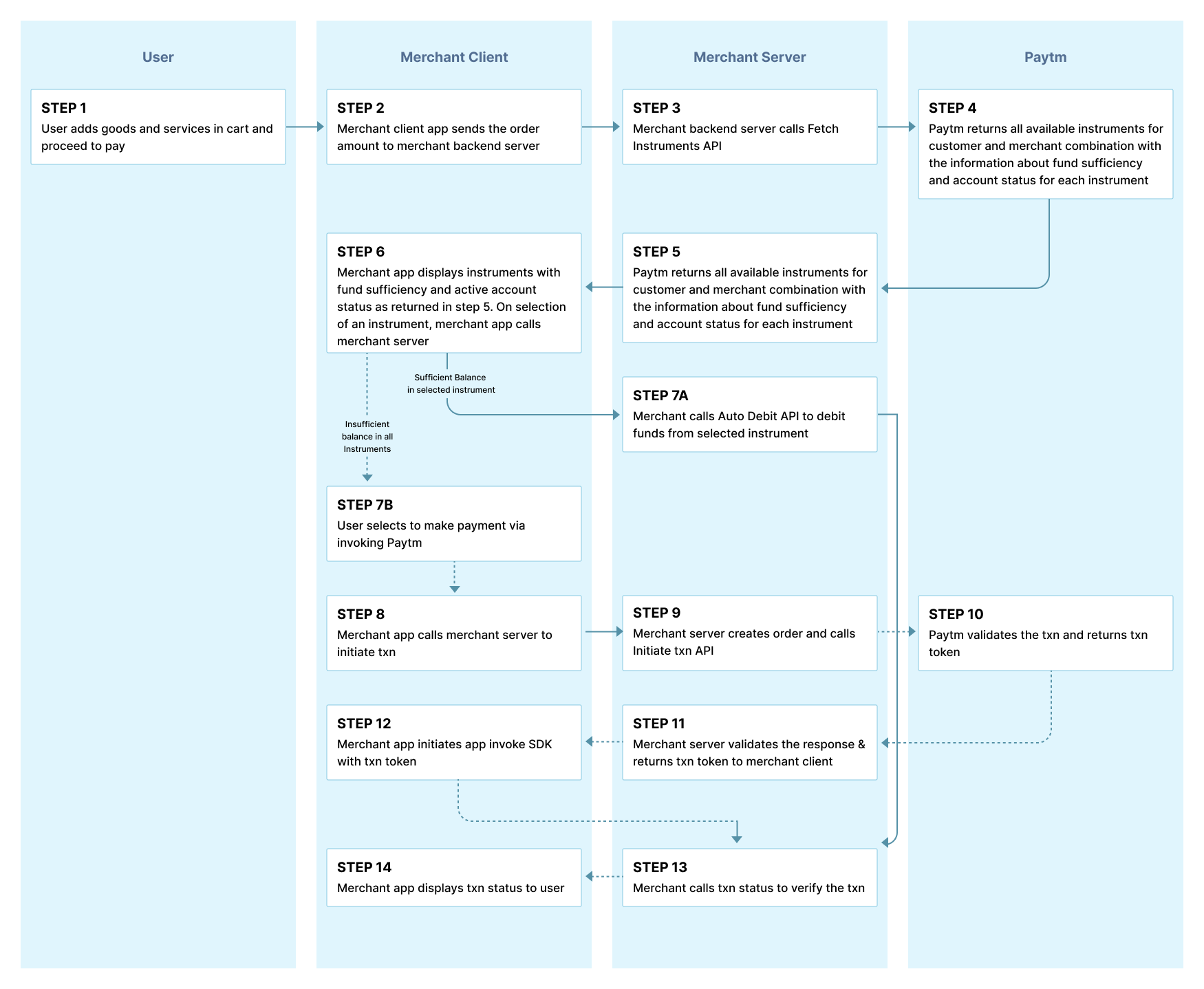

You must ensure that the user has enough balance in the selected instruments from the response of Fetch Instruments API to pay for an order before initiating the Auto Debit API.

Flow chart to show a detailed process of Paytm app invokes in case of insufficient balance:

If any of the proprietary payment instruments don’t have sufficient balance then invoke Paytm App for payment.

For example: A user has Rs. 200 in their Paytm Wallet, Rs. 150 in Paytm Postpaid and Rs. 100 in Merchant Gift Voucher. The transaction amount for the order is Rs. 500. In this case, no payment method has sufficient funds hence you need to invoke Paytm App for making payment

STEP 3: Debit amount from a user's Paytm account and confirm the transaction

Now that you have ensured that your customer has enough balance to pay for the order, you can debit the amount using the Auto Debit API and confirm the transaction using Transaction Status API.

STEP 4: Managing Refunds

If you need to cancel or refund a successful transaction, simply send a Refund API request and ensuring success using the Refund Status API.

Post completion of integration on your staging environment, do a complete transaction from order summary page on your website or mobile app

-

Attempt a test transaction using the Test Paymodes Credentials.

-

Ensure you re-verify transaction response with Transaction Status API via server to server call in payment flow and not separately as a one-time activity.

-

See the transaction details in the "Test Data" mode on your dashboard.

Once the test transaction is complete, move your code to live environment with production account details, which you would have received from Paytm.

Lastly, it's recommended that you read about Managing Refunds and late payment notifications.

In case of any issues with integration, please Get in touch.